Trend report: EAPs expand rapidly as organizations adapt to new workforce challenges

Broader, more progressive benefits produce higher engagement and better ROI.

Employee assistance programs have a long history, dating back nearly 90 years, but 2020 has brought a major shift in the need for them to be well-rounded, comprehensive and progressive.

EAPs began in the 1930s as a way to help employees deal with alcoholism. Since then, they’ve seen several evolutions, but COVID-19’s impact has rushed progressive benefits programs to the fore in an effort to meet employee needs and increase ROI.

“In a cost-basis analysis, greater use of EAPs is necessary, especially at this critical time when the pandemic has many corporate leaders rethinking the best ways to retain and support a productive and resilient workforce,” says Cheryl Brown Merriwether, executive director of the International Center for Addiction and Recovery Education and president-elect of the Greater Orlando Society for Human Resources Management.

Top management at most companies would agree an EAP is vital. A 2019 Employee Benefits report from the Society for Human Resource Management found 83 percent of businesses offer EAPs in various forms.

But of those companies, more than half the employees were unaware the program existed. According to Chestnut Global Partners’ 2016 EAP trends report, less than 7% of employees engage with their EAP.

The cost of offering an EAP goes down with greater engagement, but even 66 percent of small businesses offer some form of EAP. The more employees engage, the higher the return.

Solving the usage issue is key. The ROI per employee was a ration of 9:1—dollars saved to dollars invested—for large-sized organizations, according to the Employee Assistance Professionals Association. For medium-sized companies, it’s 5:1, and it’s 3:1 for smaller organizations. Cost savings ranged from $2,000 to $3,500 per employee when presenteeism and absenteeism went down, according to the EAPA.

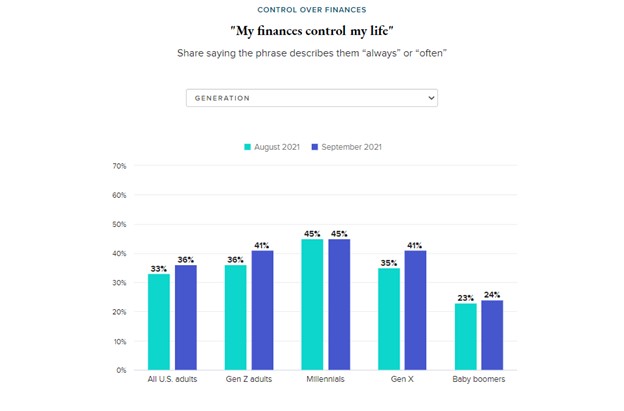

Compare this to the more than $79 to $105 billion lost annually when mental illness and substance abuse affect productivity and health care costs. Clearly, having EAPs is both affordable and necessary.

To maximize their investment, though, employers need to add benefits that appeal to a broader range of employees and routinely communicate those benefits.

Experts see a trend away from single-use EAPs and toward diverse, holistic benefits offered under an EAP umbrella. Making the EAP more accessible to more employees increases engagement and, subsequently, the ROI.

If this sounds like a wellness program, it’s because it is. While some companies refer to their EAPs separately from their wellness programs, others have already combined them, recognizing the natural overlap. Wellness experts are advocating for more of this melding of programs under the wellness umbrella.

Mental health as an indicator

The pandemic turned out to be an unexpected test of this umbrella theory.

Mental illness was already trending before COVID, but employee mental-health issues brought on by isolation, fear, job loss, and election anxiety this year skyrocketed, testing assistance programs everywhere. Organizations that had developed mental well-being resources, like the global software company SAP, found themselves better prepared for the onslaught.

And unlike the smaller percentage of workers affected by personal substance-abuse problems at any given point in time, this year’s events impacted every employee simultaneously in ways mental, physical, and financial. While employers made it easier for workers to plug into mental health benefits, they also found news ways to communicate and extend access to other programs as well.

Technology’s role

Technology continues to impact the workplace, but once again, COVID’s impact swerved to underscore just how useful it could be in keeping employees connected and engaged.

Organizations with wellness apps saw spikes in engagement even before the pandemic. After workplaces shut down across the country, employers used them to provide mental-illness support, roll out virtual-fitness classes, and offer widely-requested health assessments.

Telehealth also took a leap. EAP providers, like New Avenues, deployed tablets to connect clients with physical and mental-health providers.

The International Center for Addiction and Recovery Education’s Merriwether says there is a philosophical conflict in how to enhance access to and the user experience in EAPs. Some organizations want to take it slow, sticking with evidence-based outcomes that have been documented over the decades. Others identify issues, snag low-cost but high-quality solutions, and use them to their employees’ advantage. “These early-adopter practitioners are doing their best to research and monitor trends, maintain best practices, incorporate new methods and document results about the benefits new EAP program offerings are able to provide to the workforce in real-time,” she says. “The evidence-based results will be realized over time.”

The need for long-term for financial wellness

Expanded financial benefits will be a must-have as families cope with the economic downturn.

College loans, childcare, and medical bills converged with loss of income to form a perfect storm of employee stress. While EAPs have historically helped an individual with temporary debt issues, the modern EAP will need to cover a broader cross-section of employees struggling with long-term debt. Consequently, financial-wellness benefits now frequently include student-loan debt repayment, childcare assistance, better parental leaves policies, and convalescent leave.

And while financial counseling isn’t a new benefit, progressive EAPs add more direct individual financial planning. “EAP’s will be recognized as an essential benefit that strengthens the companies that recognize a need to evolve them,” Merriwether says.

DE&I is falling under EAP

The social-justice reckoning of 2020 brought DEI policies to the forefront. Those who are already offering employee resource groups based on shared characteristics have an advantage. Combining the power of an ERG into an EAP broadens the latter’s ability to assist with the specific needs of minority groups within a workplace. Research that shows how discrimination in the workplace affects financial, mental, and physical well-being makes it a natural issue for wellness programs.

“I recommend starting with listening,” says Lillian Humphrey, director of cultural diversity and inclusion at Power Home Remodeling, in a recent article for Technical.ly. “When you foster an open and safe workplace, employees feel comfortable sharing their voices and speaking their minds. But in order for these voices to be heard, you must encourage active listening from all parties.”

One company’s experience

The Chester, Pennsylvania-based home-improvement company Power Home Remodeling, which serves 2,700 employees nationwide, launched a Cultural Diversity & Inclusion Initiative in 2017 and holds a summit annually. The company hopes to attain a minority-employee population of more than 30% in the next few years.

The company pivoted its employee assistance program this year, keeping up with employees’ needs as they unfolded.

In the spring, employees were sent home, some working remotely while others were furloughed. As employees began to adjust to this new normal, Kristin Chalela, a senior benefits and wellness specialist at the company began receiving a high volume of messages from employees struggling with mental health.

“So, I reached out to our special events team and our executive leadership team to see if we could arrange for a mental-health speaker to lead a zoom session for the entire company,” says Chalela. “After the first speaker presentation, it became imperative for our employees to know that having a mental health outlet wasn’t just a one-time thing.”

The wellness team created a series of mental health-related activities to reassure employees and keep them connected. The average age of a Power employee is 26. Many are coming off their parents’ insurance and enrolling in Power’s benefits, which are available to them from day one of employment.

Power used its corporate health-insurance plan to access mental-health resources. It also noticed a trend in employees taking time off for self-care. The wellness team began to push for even more mental health education and resources.

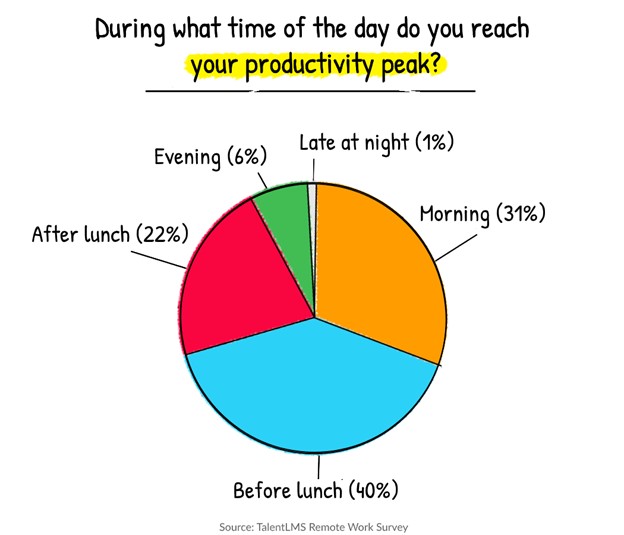

The EAP, which had once focused on opioid addiction, broadened in response to employee requests for current-needs assistance, like COVID testing and mental-health support. “We have been seeing how resources that were typically geared for individuals are now addressing the masses instead,” Chalela says. “For example, while one employee may have been struggling to remain productive pre-COVID, this is now something far more employees are experiencing as they continue to work from home.”

Power’s wellness team, like companies nationwide, is realizing that empathizing with employees and understanding their needs means addressing issues far broader than EAPs historically covered. A diversity of benefits can serve a larger population.

“One of these trends is the need to extend the continuum of care beyond the traditional mental or behavioral health care providers,” says ICARE’s Merriwether. “This situation has been devastating to the workforce, and there is a shortage of clinically trained service providers. EAP providers must be willing to allow other non-clinical professionals such as health, wellness, and recovery coaches and sobriety advocates to partner with them proactively. Employees are hungry to engage around some of these topics.”

COMMENT

Ragan.com Daily Headlines

RECOMMENDED READING

Tags: benefits, debt, EAP, mental health, technology