There’s a disconnect between HR and workers when it comes to financial benefits

The SoFi At Work report reveals a gap between how HR leaders communicate about financial well-being and what workers are hearing.

To mark Financial Literacy Month, SoFi At Work released its “The Future of Workplace Financial Well-being” report, which looks at financial well-being, literacy and benefits from the perspective of both employees and human resource leaders. SoFi At Work partnered with research firm Workplace Intelligence to survey 800 human resource leaders and 800 full-time employees in December 2021. The report findings suggest areas of agreement, disconnect and opportunities that will be noteworthy to wellness pros.

Employees and HR leaders agree that their company should be responsible for employees’ financial well-being (84% and 98%, respectively). But there’s a disconnect: 80% of HR leaders say their company is concerned about employees’ financial well-being, but only 55% of employees feel the same.

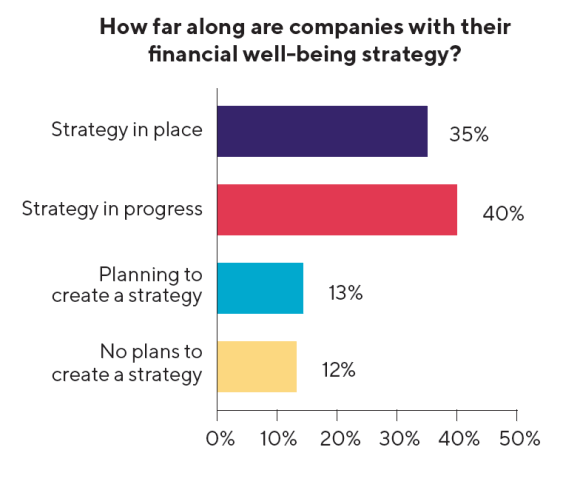

And while 74% of HR leaders said financial well-being is a top priority for workers, only 35% said they have a strategy in place to meet those needs.

With 75% of employee respondents indicating they have at least one source of financial stress — a finding that held true for employees of all ages, incomes and varying industries — the report suggests employers “may not be aware of all the ways that financial benefits can help their people and their business.”

The survey reports that employee respondents believe financial well-being benefits have an impact on some aspects of their job and well-being, including:

- Productivity – 86%

- Desire to remain with employer – 86%

- Ability to focus – 84%

- Job satisfaction and engagement – 84%

- Mental health and stress levels – 84%

- Physical health – 80%

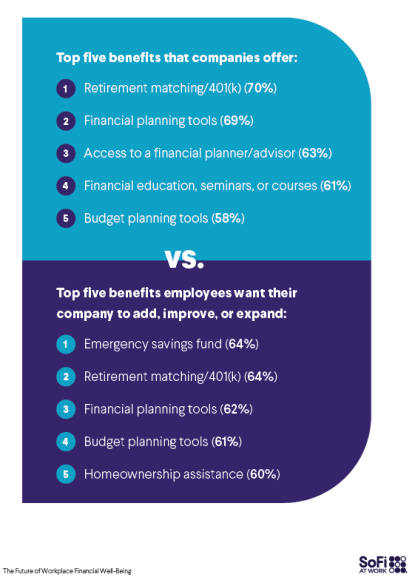

Top-of-mind benefits

The SoFi At Work survey asked both HR leaders and employees about 20 benefits, ranging from contributions to educational tools and resources. There are some notable differences between the top benefits companies offer and what employees want to see added, improved or expanded.

Another trend some employees, especially millennials, are interested in is digital money.

- Fifty-six percent of employee respondents want to learn more about investing in cryptocurrency and non-fungible tokens.

- Thirty-six percent would like their employer to add, improve or expand paying in cryptocurrency.

- Forty-two percent want their employer to add, improve or expand offering NFTs as performance rewards.

“Offering financial well-being benefits isn’t just the right thing to do — it’s also a critical way to boost employee engagement and productivity,” says Dan Schawbel, managing partner, Workplace Intelligence. “But people’s preferences are quickly evolving, and the companies who can adapt quickly are the ones that will come out on top in the war for talent.”

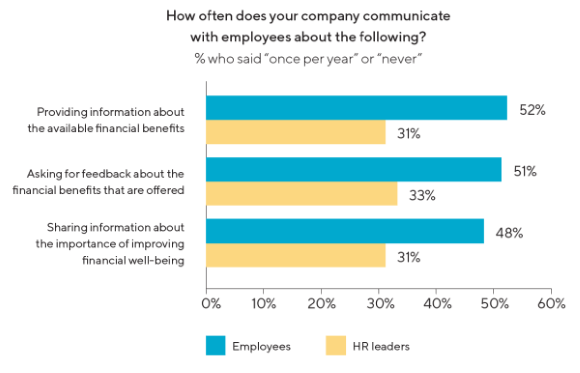

Fix the communication gap

While the priority placed on financial benefits is high — 68% of employee respondents would sacrifice at least one other key benefit in order to keep their financial benefits — the SoFi At Work survey found that on average 38% of employees are not using these benefits. Some employee respondents reported they find the quality of the financial benefit offerings to be poor (23%), they don’t know how to get started (21%) and/or they were not aware of such benefits (19%).

This points to a communication gap. Fifty-two percent of employees said their company communicates information about available financial benefits once per year or rarely, which 31% of HR leaders echo.

These communication gaps are a missed opportunity as 82% of employee respondents said it’s important to improve their financial literacy, and 71% are actively trying to do so. Also, report findings show workers often turn to their company’s financial resources for advice, and 49% say have learned a lot about finances from these tools.

One lesson for wellness and HR leaders from the SoFi At Work report is that it may be a good time to check in with your organization’s employees specifically about existing financial wellness offerings and what they would like to have. This data then could form the basis for creating or refining a financial well-being strategy. Also, it may provide insight into what educational tools or resources best suit the needs of your workforce.

As for other communication touchpoints, Aaron J. Harding, U.S. Employee Financial Wellbeing Leader at PwC, told Workplace Wellness Insider earlier this year that, “Internal communications are critical to the success of an employee financial wellness program.”

He shared three recommendations for how simply adding or adjusting communications can support financial well-being program success:

- Build financial wellness into an organization’s overall wellness program and campaigns.

- Target communications around employee life events, such as marriage or becoming a parent, as touchpoints for financial education and reminders to update to any benefits.

- Share presentations and resources out via employee resource groups to drive a different type of engagement.

COMMENT

Ragan.com Daily Headlines

RECOMMENDED READING

Tags: employee benefits, financial well-being, financial wellness, internal communications, SoFi At Work