PayPal sets its sights on employee pay equity

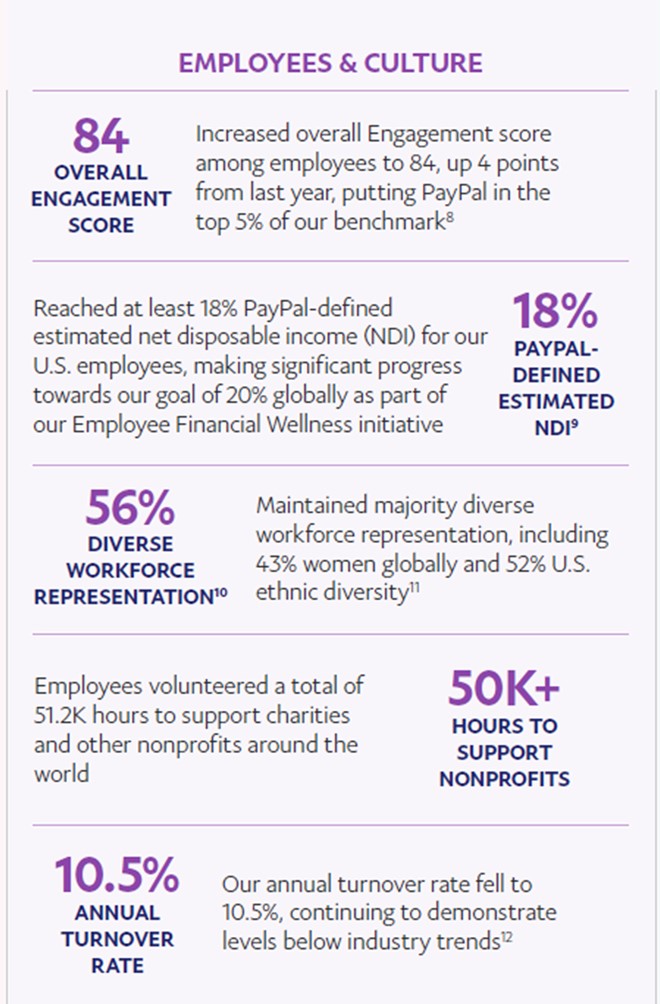

Financial well-being initiatives have produced a first-year return showing a 14-point jump in net-disposable income for some employees.

When PayPal CEO Dan Schulman saw the data and heard the employee feedback on a lack of financial wellness among the company’s lower-level employees, he decided to make raising their net disposable income a priority.

In 2019, the global online-payment company, based in San Jose, California, launched an Employee Financial Wellness Initiative and set a goal to raise employee net disposable income—generally defined as what’s left over after taxes and other obligations—by 20%. Last year, it saw U.S.-based hourly and entry-level employees’ disposable income increase as much as a 14-point jump in some markets from the previous year.

“There is no question in my mind that PayPal employees were better prepared to handle and address the challenges of the pandemic because of the financial wellness initiatives we rolled out in 2019,” Schulman said in the based company’s 2020 Global Impact Report.

PayPal accomplished this through several financial wellness measures, all of them for its 12,000 U.S. employees and some extended to its roughly 14,000 global employees. To achieve its goals, PayPal added these programs and benefits.

- Financial coaching.

- Equity grants.

- Wellness stipends for remote workers.

- Earned wage access.

- Enhanced retirement plans.

- Pay raises.

- Reduction in benefits costs.

- Offering PayPal stock options to all employees.

“At PayPal, we prioritize our employees among the stakeholders that we serve,” says Franz Paasche, chief corporate affairs officer. “This has never been more important than during the past year as our PayPal community has navigated the impact of the pandemic. By prioritizing our employees’ wellness, investing in their financial security, and creating an inclusive and supportive working environment, we can better serve our customers, shareholders, regulators and communities, and further our mission.”

Core values guide wellness efforts

PayPal defines its core values as collaboration, inclusion, innovation and wellness. When the pandemic hit, the wellness aspect became a priority. One hundred percent of its workers went remote, resulting in hardship for some employees who struggled to adjust or weren’t equipped for working from home.

To empower these employees, PayPal introduced wellness stipends to help cover the additional expenses of working from home, such as internet service, electrical bills, or equipment. The stipend was provided as part of payroll to all employees depending on their grid level, says Lisa Beyer, PayPal’s director of compensation.

The organization also expanded its EAP, providing additional tools and resources. In addition, childcare support and flexibility benefits were increased. The Crisis Leave Program gives an extra two weeks of PTO to employees affected by COVID-19.

PayPal also removed individual performance ratings and continued to pay employees whose location was temporarily closed due to pandemic impacts. An internal communications channel, dubbed Stay Informed, allowed for employee feedback and direct company responses to critical issues.

Building employee pay equity

A significant aspect of the financial wellness initiative was granting every eligible employee $4,000 to $5,000 of PayPal stock. Employees choose to cash out or hold onto the stock with a three-year vesting period. Nearly half of hourly and entry-level employees have participated in buying stock.

Beyer says the stocks provide employees with an additional financial avenue, whether to continue investing for future wealth or cashing out to pay expenses and support family. First-quarter reports showed PayPal earnings were higher than expected. Revenue grew 31% year-over-year in the quarter that ended March 31st.

Schulman is passionate about the effort to get employees financially stable. PayPal recently partnered with JUST Capital, Financial Health Network and Good Jobs Institute to advocate for employee financial wellness at America’s largest companies with the Worker Financial Wellness Initiative.

PayPal says it pays at or above average market rates for payroll. Still, it found that some employees at certain levels and in specific locations had little money left over after taxes and bills.

Beyer says one factor PayPal considered was household dependents’ income, which sometimes left employees in the negative. In response, PayPal raised employee pay at lower levels and lowered the employee contribution to company health benefits, putting more money back into their pockets. An unintended result of these changes was pay compression at higher levels.

“Team leaders, for example, were feeling that they did not benefit as much from the initiatives, and now they’ve got their teammates who are potentially taking home more than they are,” says Beyer. “That was something we had to go back and look at, and we have made additional adjustments in some cases where we did see that type of compression between our employees impacted by financial wellness and their leaders.”

Beyer says the company is continuing to monitor the situation on an ongoing basis.

Early wage access proves popular

When employee feedback determined lower-level employees were struggling to live paycheck to paycheck, PayPal contracted with the financial-services platform Even to give employees early access to their earned income.

Beyer said more than 900 employees enrolled in the program, and 43% have used the app to access their wages. The program also helps employees to create a budget and save.

The organization asked employees from a cross-section of the workforce to volunteer for its financial-health diaries, which tracks each volunteer on their financial journey. Using this and employee surveys, PayPal hopes to track its success within these programs.

PayPal uses its intranet, community bulletins, webinars, and referrals from coaching to advertise the initiatives to employees.

“We recognize it’s an ongoing journey,” says Beyer. “We continue to review and take feedback from our employees and our leaders as to what’s working and what’s not working and make the adjustments to our financial wellness program. In 2021 we are continuing to look at the data and determine what are the best next steps.”

COMMENT

Ragan.com Daily Headlines

Tags: financial wellness, pay equity, PayPal, stipends, stock