CFO buy-in is essential to success and growth of workplace wellness benefits

Measurement helps, but qualitative data also influences CFO confidence.

Matt Ellis, CFO of the telecommunication giant Verizon, understands the symbiotic relationship between workplace wellness and his company’s performance.

Even though the investment in attracting and cultivating talent is hugely expensive for the 135,000-employee behemoth, it produces a great return. “When we set our employees up for personal and professional success, they set our business up for long-term success,” Ellis says.

Ellis’ perspective, and that of all CFOs, is critical for workplace wellness. Workplace well-being has become a movement, but it doesn’t exist in a vacuum. As it gains importance, and as wellness departments expand, an inexorable evolution becomes increasingly likely to run up against an immovable force: Budgets.

Ultimately, financial decision-makers with organization-wide responsibility have to sign off on benefits and spending initiatives. Their task is to assess the ROI value of healthy and productive employees. But the c-suite’s mindset has shifted. It recognizes that wellness benefits, once seen as fringe offerings, are the new normal. Importantly, this extends to the c-suite’s financial representatives, the CFOs.

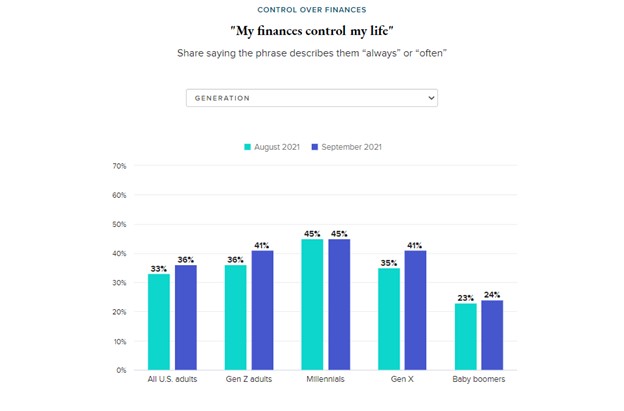

So what do CFOs think when it comes to investing in wellness benefits? An October survey by the Integrated Benefits Institute found 88% of CFOs believe cost control is one of their top five priorities. But 34% tied health benefits to strategic goals, including improving productivity, keeping hiring costs down, and improving employee engagement.

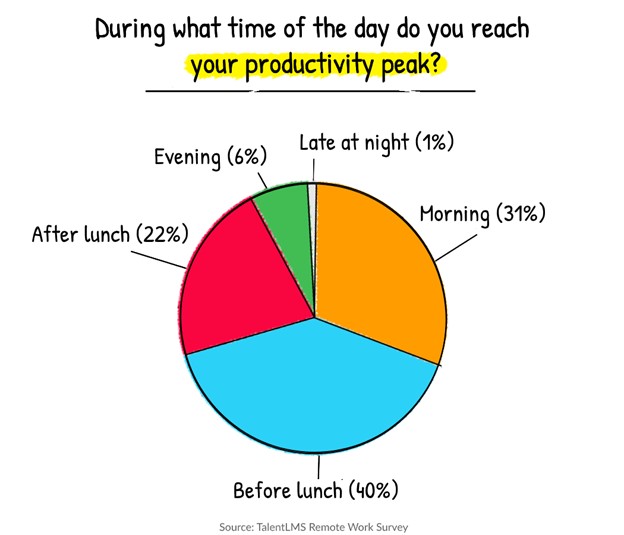

“Strategic CFOs look at getting high-performing people into the organization and supporting them, so that they’re performing at their peak,” says Heidi Pozzo, former CFO turned c-suite consultant at Pozzo Consulting. “Usually what ends up happening is you need fewer people because they’re producing more. Not because they’re working more hours, but they’re focused on all the right things. Strategic CFOs understand that, and really look at paying their people more and having benefits that support their lives.”

Strategic CFOs are culturally engaged

When the entire c-suite is on board with an organization’s strategies, it’s easier for CFOs to say yes to benefits tied to those plans. Communications plays a critical role in aligning wellness goals with organizational culture or strategic goals. When that connection is emphasized, the organization is likely to see investment support from CFOs. Strategies for accomplishing that include these things.

- Surveying employees for desired wellness benefits before choosing them.

- Measuring results with KPIs based on organizational strategy and approved by management

- Using focus groups to get qualitative feedback from employees

Pozzo says CFOs especially need to know they’re adding the right benefits at the right time, because once a benefit is added, it’s hard to take it away.

Ellis, the Verizon CFO, sees health benefits as an investment in talent. He’s led his New York City-based company in adding new benefits as demanded by the pandemic’s burden. “We want our V Teamers to feel their best, because that’s when they perform at their highest level and deliver for our stakeholders,” he says.

On top of preventative care screenings, virtual personal health tools, and robust fitness opportunities, Verizon added more childcare and caregiver benefits when schools closed last year. “We never want our employees to feel pressured to downshift their careers,” Ellis says. “Keeping them actively employed isn’t just the right thing to do, it’s a smart business strategy and good for the economy.”

How communicators should approach the CFO

When it’s time to ask for investment in wellness benefits, communicators and HR professionals make common mistakes, including assuming money is the bottom line with CFOs.

In these cases, says Greg Mansur, chief client officer for benefits provider EHE Health, benefits communicators should assume the CFO isn’t just looking for data, but also stories. “Too many people try to go into the CFO and turn everything into a dollars discussion,” Mansur says. “You need to be honest about what is truly measurable and what is measurable in some more qualitative fashion. Lay out what you think you can get to and how you’re going to demonstrate that value over time.”

The Integrated Benefits Institute survey found that CFOs express the most confidence in their benefits when they see tracked goals or heard positive stories about employee health. The survey also found the metrics that had the biggest impact on CFO confidence in the business value of their health benefits include these:

- Employee health status

- Employee satisfaction

- Financial ROI

- Operational KPIs

- Engagement

- Mental health status

“For the strategic CFOs, it’s not going to require a whole lot because they already know that the people need to be supported,” says Pozzo. “Building the case for that is pretty easy. The CFO knows if you get the right structure around the people, whether it’s benefits, work, environment, whatever it is, the case is really strong because people will knock it out of the park.”

COMMENT

Ragan.com Daily Headlines

RECOMMENDED READING

Tags: benefits, CFO, investment, Verizon, Wellness